nd sales tax exemption form

Ad Complete IRS Tax Forms Online or Print Government Tax Documents. Sales Tax Exemptions in North Dakota.

Tax And Financial Management Taxes Seaso Premium Photo Freepik Photo Background Business Money Text Tax Rules Financial Management Income Tax

From sales or use tax imposed by the state of North Dakota enter ND in the boxes provided.

. How to use sales tax exemption certificates in North Dakota. The sales tax applies to the gross receipts of all retail sales including the sale lease or rental of tangible personal property or any product transferred electronically and the sale of services. To get started on the document use the Fill camp.

Provide the social security number or FEIN may delay or prevent the processing of this form. To apply for a sales tax exemption the taxpayer must submit a letter of application to the Office of State Tax Commissioner by email or mail. Who should use this form.

OFFICE OF STATE TAX COMMISSIONER CERTIFICATE OF RESALE SFN 21950 11-2002 I hereby certify that I hold _____ Sales and Use Tax permit number_____. Enter your official contact and identification details. Family-Run Business With Over 20 Years Proven Experience Shop Our Top Sellers Here.

The state sales and use tax rate is 45. The One Time Remittance form is for one-time sales and use tax remittance only. A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the North Dakota sales tax.

Sales tax exemption Created Date. Include items listed in the Sales Tax Exemption Application Approval Requirements and include the Property Tax Clearance Record form with the application letter. Press Done after you complete the form.

If you are claiming exemption for more than one member. Form NDW-M - Exemption from Withholding for a Qualifying Spouse of a US. 182015 15758 PM.

Taxpayer name address Federal Employer Identification Number and North Dakota sales and use tax permit number. South Dakota Streamlined Sales and Use Tax Agreement Certificate of Exemption Instructions Use this form to claim exemption from sales tax on purchases of otherwise taxable items. Check this box if this exemption certificate is being.

Form 307 North Dakota Transmittal of Wage and Tax Statement - submitted by anyone who has an open withholding account with the Office of State Tax Commissioner and does not file electronically. A North Dakota resale certificate also commonly known as a resale license reseller permit reseller license and tax exemption certificate is a tax-exempt form that permits a business to purchase goods from a supplier that are intended to be resold without the reseller having to pay sales tax on them. Address the Support section or contact our Support crew in the event youve got any concerns.

Office Use Only This application should be filed only by federal state local or tribal governments. Find sales and use tax information for North Dakota. I further certify that I will report and remit any sales or use tax and any penalties which attach as a result of purchases from.

How you can fill out the Get And Sign North Dakota Form Sales 2016-2019 on the internet. In North Dakota certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. If you are claiming exemption for more than one member state complete the SSUTA Certificate of Exemption.

Now youll be able to print download or share the form. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The letter should include.

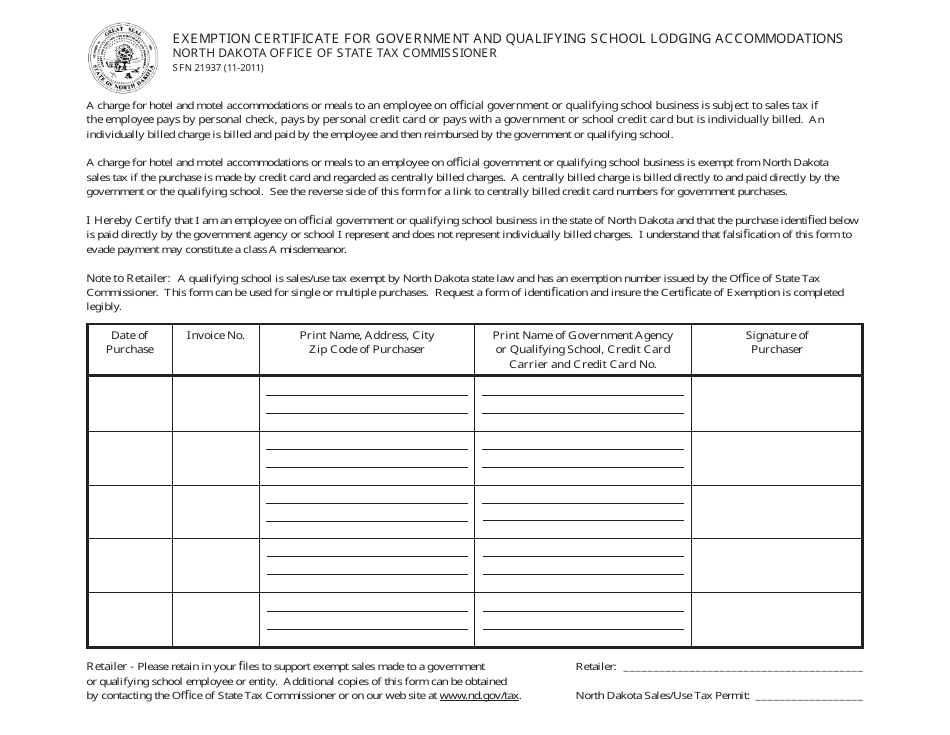

Falsifi cation of this form to evade payment of tax is a class A misdemeanor and may be punishable by a fi ne up to 15000 or imprisonment up to one year or both. Ad Highest Quality Senior Facility Products At The Best Prices Bulk Wholesale Specials. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases.

See the Exempt Organizations guideline for more detail about organizations that qualify for a sales tax exemption on purchase transactions. And will be used for tax reporting identification and administration of North Dakota tax laws. With certain limited exceptions the Streamlined Sales and Use Tax Certificate of Exemption and Form E-595E require either a sales and use tax registration number or an exemption number.

The purchaser must complete all fields on the exemption certificate and provide the fully completed certificate to the seller in order to claim exemption. I am engaged in the business. North Carolina Form E-595E Streamlined Sales and Use Tax Certificate of Exemption is to be used for purchases for resale or other exempt purchases.

Several examples of exemptions. You can download a PDF of the North Dakota Streamlined Sales Tax Certificate of Exemption Form SST on this page. TRIBAL CLAIM FOR TAX EXEMPTION North Dakota Department of Transportation Motor Vehicle SFN 18085 5-2016 MOTOR VEHICLE DIVISION ND DEPT OF TRANSPORTATION 608 E BOULEVARD AVE BISMARCK ND 58505-0780 Telephone 701 328-2725 Website.

This is a Streamlined Sales Tax Certificate which is a unified form that can be used to make sales tax exempt purchases in all states that are a member of the Streamlined Sales and Use Tax Agreement. Hospitals nursing homes intermediate care. Ad New State Sales Tax Registration.

Name and physical address of the project. The advanced tools of the editor will guide you through the editable PDF template. For example if you are claiming an exemption from sales or use tax imposed by the state of North Dakota enter ND in the boxes provided.

What Is A Sales Tax Exemption information registration support. If you hold a North Dakota sales and use tax permit you may file your sales and use tax returns over the. NORTH DAKOTA OFFICE OF STATE TAX COMMISSIONER.

Sign Online button or tick the preview image of the blank. 08 Real estate 09 Rental and leasing 10 Retail trade 11 Transportation and warehousing 12 Utilities. Tangible personal property used to construct or expand telecommunications service infrastructure in North Dakota is exempt form sales and use tax effective July 1 2009 through June 30.

This page discusses various sales tax exemptions in North Dakota. Form 301-EF - ACH Credit Authorization. APPLICATION FOR SALES TAX EXEMPTION CERTIFICATE OFFICE OF STATE TAX COMMISSIONER.

If you have a North Dakota Sales Tax Permit please use ND TAP to submit any sales and use tax you owe when you file your return. SSTGB Form F0003 Exemption Certificate Revised 12212021 Streamlined Sales Tax Certificate of Exemption Do not send this form to the Streamlined Sales Tax Governing Board. Other North Dakota Sales Tax Certificates.

Application For Sales Tax Exemption Certificate. For additional information on sales tax please refer to our Sales Tax Guide PDF. While the North Dakota sales tax of 5 applies to most transactions there are certain items that may be exempt from taxation.

Registered users will be able to file and remit their sales taxes using a web-based PC program. North Dakota Sales Tax Taxpayer Access Point TAP is an option offered by the Office of State Tax Commissioner to all sales tax permit holders. Make use of the Sign Tool to create and add your electronic signature to signNow the North Dakota tax refund for Canadian residents form.

Sales tax rates remote seller nexus rules tax holidays amnesty programs and legislative updates. Send the completed form to the seller and keep a copy for your records. Please note that North Dakota may have specific restrictions on how exactly this form can be used.

Single purchase exemption certificate. North Dakota residents to pay use tax on goods purchased tax free from out-of-state sellers. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to.

Income From House Properties Exemption Relief And Practice Questions

Resource Html Uri Comnat Swd 2021 0049 Fin Eng Xhtml Swd 2021 0049 Fin Eng 24030 Jpg

How To Comply With Us Sales Tax For Online Courses

Real Property Tax Exemption Information And Forms Town Of Perinton

I Bought A Taxable Item And The Seller Didn T Charge Sales Tax Do I Have To Pay The Tax Anyway

Original 1961 Chevrolet Bel Air Owners Guide With Original Bill Of Sal Chevrolet Bel Air Chevrolet Bel Air

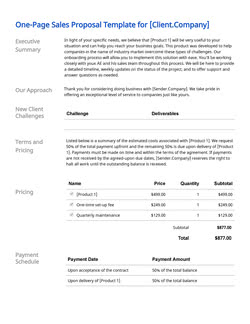

167 Free Business Proposal Templates Updated In 2022

Vatupdate Newsletter Week 20 2022 Vatupdate

What Is A Resale Certificate And Who Can Use One Sales Tax Institute

Resource Html Uri Comnat Swd 2021 0049 Fin Eng Xhtml Swd 2021 0049 Fin Eng 25023 Jpg

When Can Farmers Deduct Prepaid Expenses

Original 1961 Chevrolet Bel Air Owners Guide With Original Bill Of Sal Chevrolet Bel Air Chevrolet Bel Air

Charitable Organizations In Singapore From Clan Based To State Facilitated Endeavors

Original 1961 Chevrolet Bel Air Owners Guide With Original Bill Of Sal Chevrolet Bel Air Chevrolet Bel Air

Sales Tax Exemption Renewal Harbor Compliance

Form Sfn21937 Download Fillable Pdf Or Fill Online Exemption Certificate For Government And Qualifying School Lodging Accommodations North Dakota Templateroller