kansas dmv sales tax calculator

The minimum is 65. Or less 4225 Autos 4501 lbs.

Motor Vehicle Fees And Payment Options Johnson County Kansas

He earned his law degree in 1979 from the Washburn University School of Law and his Masters of Laws in Taxation degree from the University of Missouri at Kansas City in 1984.

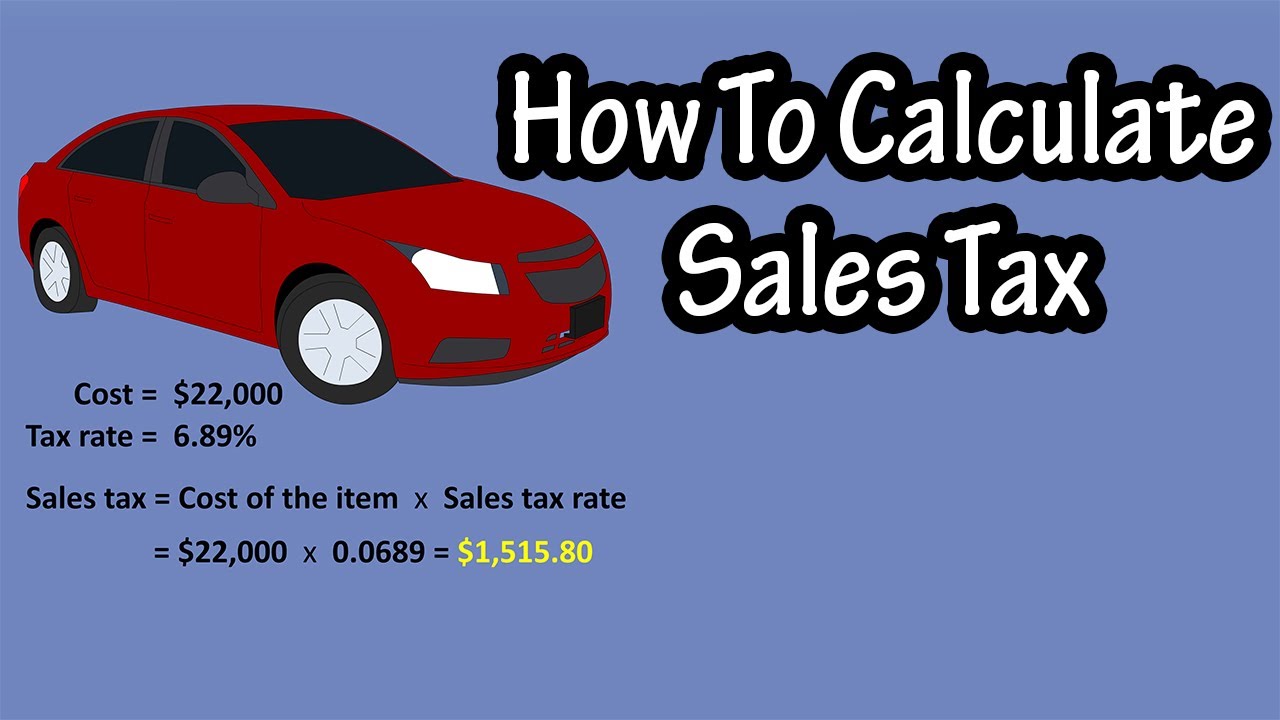

. Multiply the vehicle price before trade-in or incentives by the sales tax fee. Price of Car Sales Tax Rate. Department of Revenue guidelines are intended to help you become more familiar with Kansas.

New car sales tax OR used car sales tax. If not a Kansas Dealer a bill of sale is required is amount of sale is not on the back of title. The sales tax rate varies by County.

Kansas collects a 73 to 8775 state sales tax rate on the purchase of all vehicles. How to Calculate Kansas Sales Tax on a Car. This includes the rates on the state county city and special levels.

Title fee is 800 tag fees vary according to type of vehicle. Title and Tag Fee is 1050. The sales tax rate for Shawnee was updated for the 2020 tax year this is the current sales tax rate we are using in the Shawnee Kansas Sales Tax Comparison Calculator for 202223.

Schools Special Hunting Opportunities. From July 1 2006 through June 30 2009 KSA. For your property tax amount use our Motor Vehicle Property Tax Estimator or call 316 660-9000.

The average cumulative sales tax rate in Mcpherson Kansas is 9. If you are unsure call any local car dealership and ask for the tax rate. Choose a search method VIN 10 character minimum Make-Model-Year RV Empty Weight And Year.

Kansas has a 65 statewide sales tax rate but also has 531 local tax jurisdictions including. This page covers the most important aspects of Kansas sales tax with respects to vehicle purchases. Bill of Sale is a affidavit which must include vehicle identification number year make signature of seller and name and address of the buyer The county will collect the sales tax.

Motorized Bicycle 2000. Marion County Treasurers office is now offering a new service that you can use to estimate the cost of your vehicle renewals or new purchases even trade-ins. Once you have the tax.

You cannot register renew or title your vehicle s at the Treasurers office located in the. To calculate the sales tax on your vehicle find the total sales tax fee for the city. Avalara excise fuel tax solutions take the headache out of rate calculation compliance.

Or less 4225. Dealership employees are more in tune to tax rates than most government officials. Secretary Burghart has more than 35 years of experience combined between private and public service in tax law.

Your vehicle renewals will cost. For your property tax amount refer to County Treasurer. Multiply the vehicle price after trade-ins andor incentives by the sales tax fee.

Ad Avalara solutions can help you determine energy and fuel excise tax with greater accuracy. This will be collected in the tag office if the vehicle was. Contact your County Treasurer for an closer estimate of.

620 382-3106 Kansas Only Toll Free. For the property tax use our Kansas Vehicle Property Tax Check. If this rate has been updated locally please contact us and we will update the sales tax rate for Shawnee Kansas.

The sales tax in Sedgwick County is 75 percent InterestPayment Calculator. When paying in person at the kiosk at either the Olathe or Mission location the credit card convenience fee is 24 of the total transaction amount. When purchasing a vehicle the tax and tag fees are calculated based on a number of factors including.

When paying in person at the counter at either the Olathe or Mission location the credit card convenience fee is 26 of the total transaction amount with a 3 minimum subject to change. Tax Season Vehicle License Fee VLF paid for tax purposes Select a Calculator to Begin Registration renewal fees Registration fees for new vehicles that will be purchased in California from a licensed California dealer Registration fees for new resident vehicles registered outside the state of California Registration fees for used vehicles that will be purchased in California. The county the vehicle is registered in.

Whether or not you have a trade-in. Maximum Local Sales Tax. In this example multiply 38000 by 065 to get 2470 which makes the total purchase price.

Sales tax in Shawnee Kansas is currently 96. Modernization Fee is 400. How Kansas Motor Vehicle Dealers and Leasing Companies Should Charge Sales Tax on Leases.

Vehicle tax or sales tax is based on the vehicles net purchase price. The minimum is 725. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

For your property tax amount use our Motor Vehicle Property Tax Estimator or call 316 660-9000. There are also local taxes up to 1 which will vary depending on region. Vehicle property tax is due annually.

Tax and Tags Calculator. Its fairly simple to calculate provided you know your regions sales tax. Vehicle Tax Costs.

To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county. The sales tax rate for Shawnee was updated for the 2020 tax year this is the current sales tax rate we are using in the Shawnee Kansas Sales Tax Comparison Calculator for 202223. When using the Property Tax Check keep in mind that our office will pro-rate your property tax from your.

Mcpherson is located within McPherson County KansasWithin Mcpherson there is 1 zip code with the most populous zip code being 67460The sales tax rate does not vary based on zip code. Sales tax will be collected in the tag office if the vehicle was bought from an individual or purchased out of state. Or more 5225.

The state in which you live. Revised guidelines issued October 1 2009. What you need to know about titling and tagging your vehicle.

Maximum Possible Sales Tax. Sales tax will be collected in the tag office if the vehicle was bought from an individual or purchased out of state. 1 Manufacturers rebates are now subject to tax.

Motor vehicle titling and registration. Average Local State Sales Tax. You can use our Kansas Sales Tax Calculator to look up sales tax rates in Kansas by address zip code.

You pay property tax when you initially title and register a vehicle and each year when you renew your vehicle tags and registration. To calculate sales tax visit Kansas Department of Revenue Sales Tax Calculator. For example imagine you are purchasing a vehicle.

This will start with a recording. DO NOT push any buttons and you will get an information operator. Use this online tool from the Kansas Department of Revenue to help calculate the amount of property tax you will owe on your vehicle.

For additional information click on the links below. The type of license plates requested. Kansas Vehicle Property Tax Check - Estimates Only Search for Vehicles by VIN -Or- Make Model Year -Or- RV Empty Weight Year Search By.

Sales and Use Tax. The Department collects taxes when an applicant applies for title on a motor vehicle trailer all-terrain vehicle boat or outboard motor unit regardless of the purchase date. Burghart is a graduate of the University of Kansas.

Home Motor Vehicle Sales Tax Calculator. For vehicles that are being rented or leased see see taxation of leases and rentals. Kansas State Sales Tax.

Sales Tax receipt if Kansas Dealer.

How To Calculate Sales Tax For Vermont Title Loophole Cartitles Com

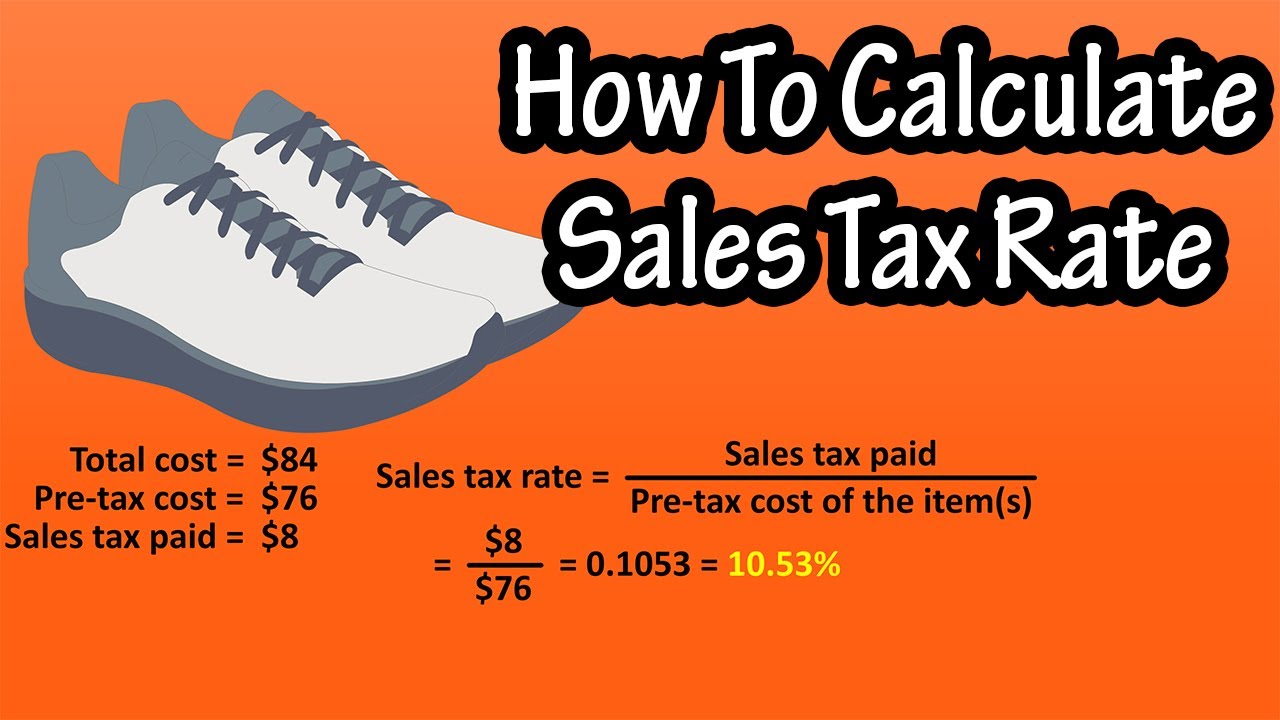

How To Calculate Find The Sales Tax Rate Or Percentage Formula For Calculating Sales Tax Rate Youtube

Car Tax By State Usa Manual Car Sales Tax Calculator

Connecticut Sales Tax Calculator Reverse Sales Dremployee

Pennsylvania Sales Tax Small Business Guide Truic

Sales Tax On Cars And Vehicles In Kansas

How To Calculate Sales Tax Methods Examples Video Lesson Transcript Study Com

Kansas Vehicle Sales Tax Fees Find The Best Car Price

Dmv Fees By State Usa Manual Car Registration Calculator

Kansas Vehicle Sales Tax Fees Find The Best Car Price

Car Tax By State Usa Manual Car Sales Tax Calculator

Car Tax By State Usa Manual Car Sales Tax Calculator

Missouri Car Sales Tax Calculator Missouri Cars For Sale Country Club Plaza

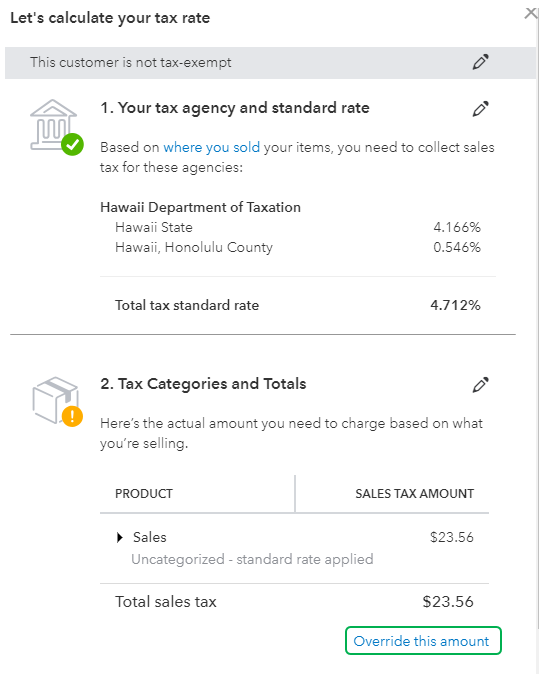

Solved Should I Enter My Sales Tax As An Expense Every Time I Pay It Or Is That Automatically Figured Into My Profit And Loss Statement From The Sales Tax Program

How To Calculate Sales Tax How To Find Out How Much Sales Tax Sales Tax Calculation Youtube